how to check my unemployment tax refund online

Check your refund status online 247. Your Social Security number or Individual.

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Select the name of the vendor who submitted the refund check.

. Postal Service your refund check may be returned to the IRS. The IRS online Wheres My Refund. Another way to see if the refund was issued is to view ones tax transcript.

Another way is to check your tax transcript if you have an online account with the IRS. I already got my unemployment refund from my state in the middle of June. Using the IRS Wheres My Refund tool.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Portal allows you to track the payment you simply need to input the following information. As the IRS is in the middle of a busy tax season and is also overseeing the distribution of the third stimulus check and the.

How do I check on my unemployment tax refund. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. To report unemployment compensation on your 2021 tax return.

I filed at the beginning of March. The good news is the the IRS has reviewed the first round of Unemployment Calculation Exclusion UCE for about 21000 filers. Viewing your IRS account.

Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities. Choose the form you filed from the drop. You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools.

Check For the Latest Updates and Resources Throughout The Tax Season. This can be accomplished online by visiting IRSgov and logging into an individual account. This is available under View Tax Records then click the Get Transcript button and choose the.

I am a single filer my parents claimed me as a dependent. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. Select the tax year for the refund status you want to check. To request a copy of.

You must have your social security number and the exact amount of the refund request. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Your social security number or ITIN Your filing.

However you can find out when the irs processed your refund and for how much by viewing your tax. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state. Sadly you cant track the cash.

Online portal allows you to track your IRS refund. Contact the BFSs TOP call center at 800-304-3107 or TDD 866-297-0517 Monday through Friday 730 am. Refund checks are mailed to your last known address.

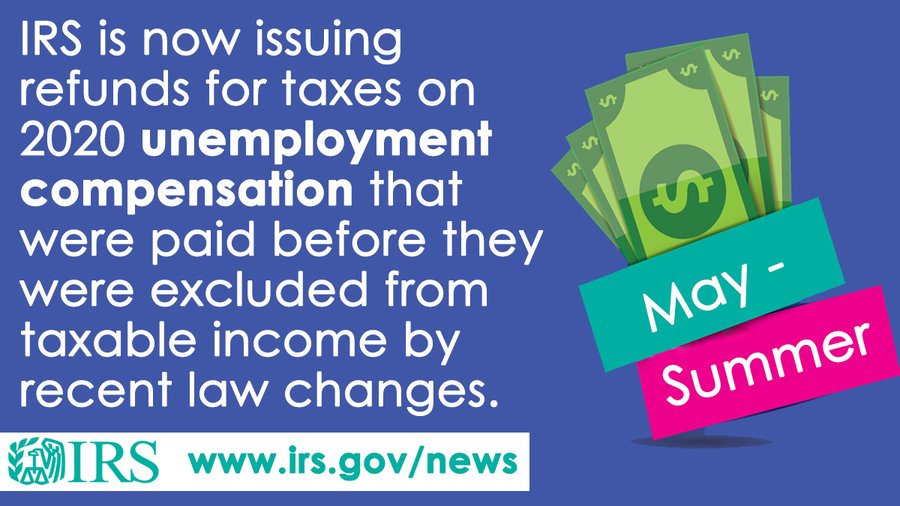

If you move without notifying the IRS or the US. The bill makes the first 10200 of federal. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your. How to check your unemployment tax refund online. Still they may not.

Contact the IRS only if your original refund amount. In may the irs said. Enter your Social Security number.

Select Check the Status of Your Refund found on the left side of the Welcome Page. Visit us to learn about your tax responsibilities check your refund status and use our online servicesanywhere any time. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Timeline Here S When To Expect Yours

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

How To Receive Your Unemployment Tax Refund As Usa

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Still Waiting For Your 10 200 Unemployment Tax Refund How To Check Status Dailynationtoday

Here S How To Track Your Unemployment Tax Refund From The Irs

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It

Confused About Unemployment Tax Refund Question In Comments R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Fourth Stimulus Check News Summary Friday 11 June 2021 As Usa